It may seem counterintuitive to choose an investment option in a category that implies risk. Always keep in mind, however, that financial markets only reward risk. Most of the options discussed in the previous section make terrible long-term investments because the low risk translates into poor returns.

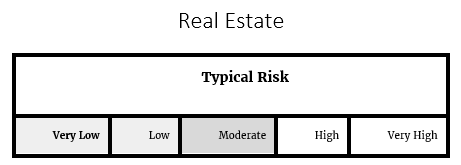

Real estate can subject its investors to extreme risk. The meltdown of 2008 demonstrated that real estate does not always appreciate. Real estate comes with additional risks not present in other asset classes. Environmental risks and maintenance costs must be weighed against potential profits when investing in real estate.

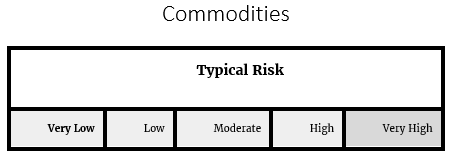

Commodities

Many investors like to hold commodities because they tend to be uncorrelated with the broader market. The biggest criticism is that a bushel of corn is worth a bushel of corn—there is no appreciation of value through growth when it comes to commodities. In the end, they reason, commodity investments are nothing more than a hedge on inflation. In addition, it is often expensive to hold commodities since they need to be actively managed through futures contracts.

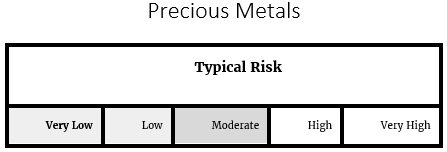

Precious Metals

Precious metals have the same criticisms as basic commodities. The generally don’t get more valuable over time other than as a hedge against inflation. When investors fear that markets will go down, they tend to buy gold, which means that in some past periods of decline, there has been a sharp rise in the price of precious metals. As with the energy, some investors prefer to invest in companies—such as miners—that are tied to the commodity but still stand to achieve growth through production. These companies also tend to be negatively correlated with the overall market.

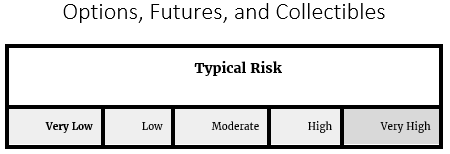

These investment types are often very complex, and there are other barriers to entry without extensive study. I’m not opposed to owning these investments, but know that the risk can be catastrophic if they are not managed properly. I am classifying them as “beyond the scope of this book.”

Last Updated: 6/25/2018